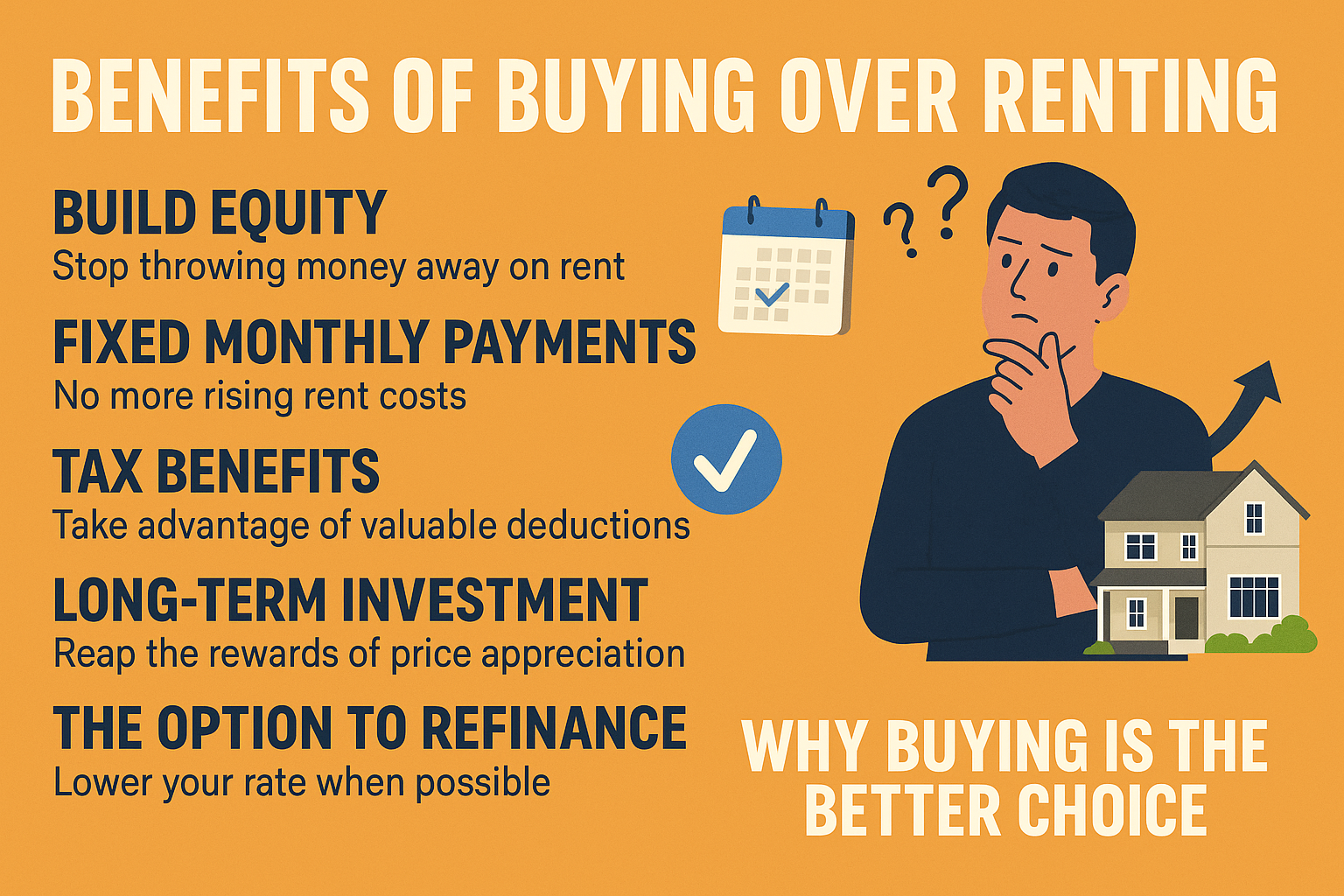

Why Keep Paying Rent When You Could Be Building Wealth?

Why Keep Paying Rent When You Could Be Building Wealth?

Let’s be real—renting is easy… but it’s also a financial dead end. Every rent check you send is money you’ll never see again. But when you own a home, every payment builds your equity—a real, growing asset that belongs to you. Even with higher interest rates, the long-term benefits of buying far outweigh the short-term convenience of renting.

🧱 Build Equity, Not Someone Else’s Wealth

Rent is 100% interest. When you own a home, part of every mortgage payment goes toward building equity—your stake in a valuable asset. Over time, that equity becomes one of the most powerful tools for growing wealth and financial stability.

📅 Fixed Payments = Peace of Mind

Tired of rent increases? Homeowners with a fixed-rate mortgage lock in the same monthly payment for years to come. Meanwhile, renters are subject to yearly hikes and unpredictable changes. Buying a home lets you predict your future—and plan for it.

💰 Tax Breaks You Can’t Get While Renting

Homeowners enjoy powerful tax advantages like deductions for mortgage interest and property taxes. These perks can lower your taxable income and save you thousands over time—benefits renters don’t receive.

📈 Property Appreciation = Wealth Over Time

Think buying now is “too expensive”? Real estate is a long game. Home values tend to rise over time, meaning that home you buy today could be worth significantly more in the future. Renters? They’re just along for the ride.

🔁 You Can Refinance Later

High interest rate today? You’re not stuck with it forever. When rates drop, homeowners can refinance and reduce their payments. Renters don’t get that option—they just get another lease renewal… with a higher price tag.

✅ Renting Feels Safe—But Buying Builds a Future

Yes, renting might feel flexible, but it comes at the cost of financial growth. Buying a home gives you stability, tax benefits, wealth-building power, and an exit plan that renting never will.

So, ask yourself:

Are you building your future—or someone else’s?

Ready to take the first step toward ownership?

Let’s talk! I can help you explore financing options, first-time buyer programs, and even $0-down opportunities. The market might feel intimidating—but with the right guidance, it’s yours for the taking.

Check out my First Time Homebuyer's Guide HERE

Categories

Recent Posts

Teresa Davis

REALTOR® and Licensed Loan Originator | License ID: 308937 / NMLS# 2597433